The Bank of England sets the base interest rates that the rest of the UK banks will follow, doing so allows them to control the UK inflation rate, which therefore allows them to dictate how much spending and saving occurs.

- A high Interest rate, will mean that savers will prosper as their savings will mature and eventually have more than what they started with.

- A low interest will mean that individuals are more likely to spend and therefore the economy will improve as the pound will strengthen against other currencies.

Businesses are more likely to buy large quantities during low interest times as the products will be cheaper, this also means that they can save on storage costs as the loan repayments will also come with less interest rates, proving a better investment than ones bought during a boom.

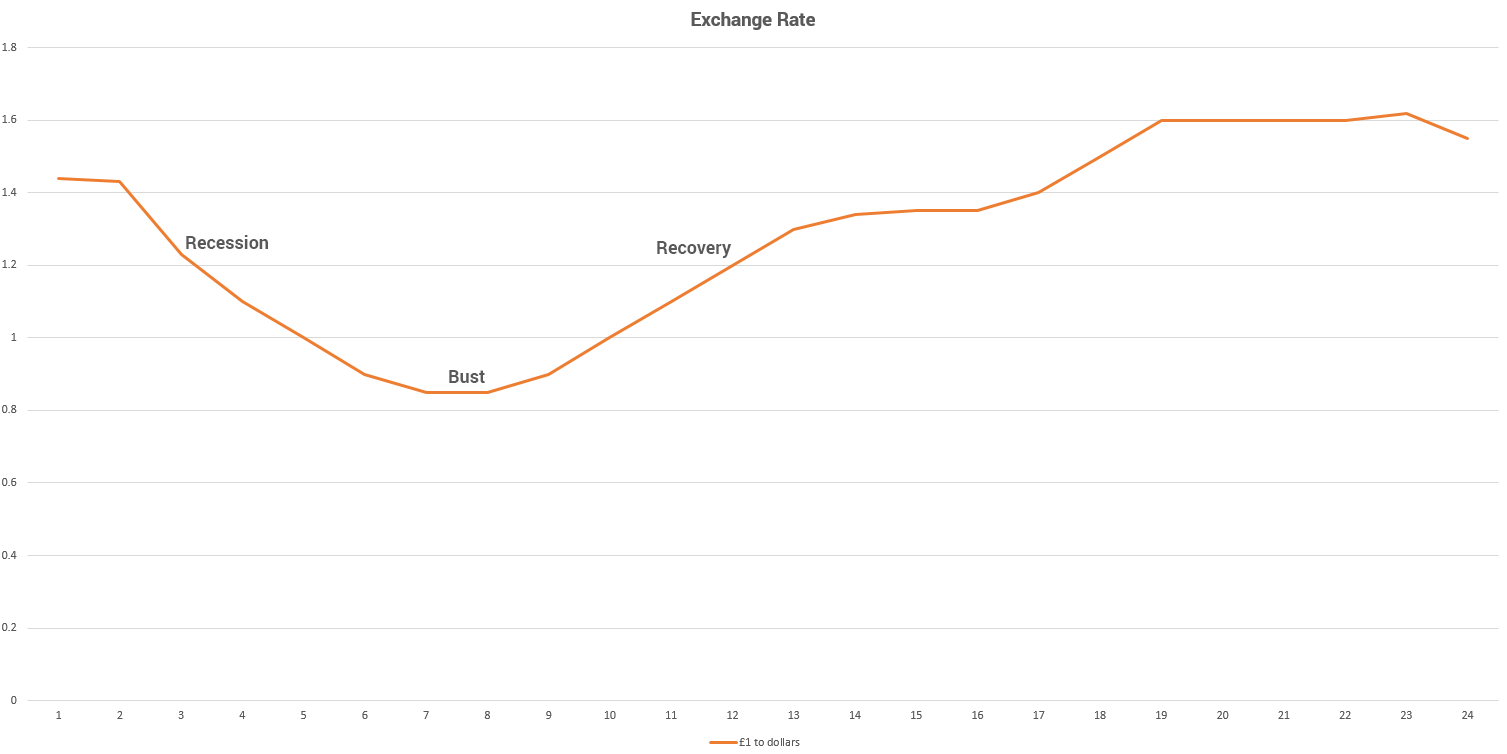

Above is a large graph that shows an example of an exchange rate, as you can see a Recession,Bust and Recovery are marked on the graph, during that time several stages will occur that aim to bring the economy back into normality, or a strong pound.

On the second period the beginning of the Recession occurs, at this time businesses will start to notice a drop in profits, and consumers will notice an increase in prices, this is where the UK has entered a recession, additionally unemployment will likely increase as businesses have to recover costs and plan for a rough time ahead. To try to aviod this, the Bank of England will lower the interest rate to try to improve spending.

During the Bust Period, Businesses that are luxury, high value and extravagant expenses will do poorly as potential customers are spending the money they have , business costs on warehouses and factorys however will decrease as the loan repayment percentage return is reduced. The Bank of England will keep the exchange rate low so that customers spend their money to boost the economy.

Then, the UK economy should improve and businesses will start to see more money flowing threough the tills, this is probably because The Bank of England has started to raise interest rates. This is beneficial for the savers, as their money will go further than before, having a higher interest rate, and the spenders who owe loans will see that the repayments for their loans will increase again. This is called a Recovery or Boom.